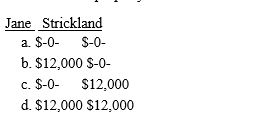

Jane receives a nonliquidating distribution of land with a fair market value of $30,000 and a basis of $18,000 from Strickland Corporation,an S corporation.Jane's basis in the stock is $46,000.What must Jane and Strickland report as income from the property distribution?

Definitions:

Strip Bond

A type of bond investment where the coupon payments and the principal are separated and sold individually as zero-coupon instruments.

Yield Rate

The annual income return on an investment, expressed as a percentage of the investment's price.

Annual Compound Rates

The rate of return that is earned on an investment or paid on a loan when interest is compounded on an annual basis.

RRSP

The Registered Retirement Savings Plan (RRSP) is a Canadian investment vehicle for individuals to save for retirement, with contributions being tax-deductible and growth being tax-deferred.

Q15: What body prepares a compromise version of

Q21: On March 23,2016,Saturn Investments Corporation purchases a

Q30: With the adoption of GASB statement #35

Q37: A Keogh plan is administratively more convenient

Q41: Knox Cable Corporation has the following gains

Q42: Which of the following statements concerning the

Q45: On June 1, 20X5, the books

Q49: The financial statements required for public healthcare

Q52: Coffin Corporation (a domestic corporation)has $200,000 of

Q77: A Keogh plan is a type of