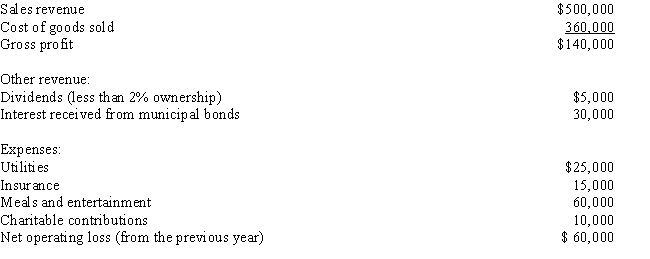

Calvin Corporation,has the following items of income and expense for the current year.Calculate (a)Calvin's taxable income and (b)income tax liability.

Definitions:

High Dividend Payout

Refers to companies that return a large portion of their earnings to shareholders in the form of dividends, often signaling financial strength.

Flotation Costs

Expenses incurred by a company when issuing new securities, including legal, underwriting, and advertising costs.

Real World

A term referring to actual conditions and practical experiences in everyday life, as opposed to theoretical or simulated environments.

Automatic Dividend Reinvestment

A program that automatically uses dividends paid by investments to purchase more shares of those investments.

Q19: A not-for-profit hospital uses three revenue-controlling accounts:

Q20: Sally owns 700 shares of Fashion Styles

Q24: Dwayne is upset by an IRS agent's

Q24: On September 23, Gensil Company buys

Q25: On January 1, 2015, Duke Company negotiated

Q27: Third-party exchange<br>A)Losses are never deferred.<br>B)Can be within

Q32: The Statement of Realization and Liquidation reports

Q42: The Rector Corporation maintains a SIMPLE-IRA retirement

Q80: Mariana is a partner in the Benson

Q108: During 2016,Ester recognizes a $10,000 Section 1231