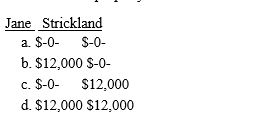

Jane receives a nonliquidating distribution of land with a fair market value of $30,000 and a basis of $18,000 from Strickland Corporation,an S corporation.Jane's basis in the stock is $46,000.What must Jane and Strickland report as income from the property distribution?

Definitions:

Emotional Appeals

Persuasive techniques that attempt to influence an audience by eliciting strong feelings rather than by using facts or logic.

Scientific Method

A process involving the rigorous, systematic application of observation and experimentation.

Identify Problem

The process of recognizing and defining an issue or challenge that needs to be addressed.

Conflicting Information

Situations where different sources provide information that is contradictory, leading to confusion and difficulty in making decisions.

Q12: The alternate valuation date is how many

Q13: The FASB requires entities that hold or

Q22: A sole proprietor may deduct investment interest

Q28: Assuming that no stipulation is made in

Q33: Title 26 of the United States Code

Q36: Violet exchanges investment real estate with Russell.Violet's

Q49: On July 17,2016,Elise purchases office furniture (7-year

Q55: Stan sells a piece of land he

Q73: Tax statute<br>A)Tax Court Reports<br>B)United States Tax Cases<br>C)Internal

Q98: Cary is an employee with the Bayview