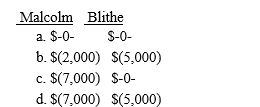

Malcolm receives a liquidating distribution of land with a fair market value of $14,000 and a basis of $19,000 from Blithe Corporation,an S corporation.Malcolm's basis in the stock is $21,000.What must Malcolm and Blithe report as income (loss)from the property distribution?

Definitions:

Salivating

The production and release of saliva in the mouth, often in response to the anticipation of food, through a reflex action.

Conditioned Stimulus

A previously neutral stimulus that, after becoming associated with an unconditioned stimulus, eventually triggers a conditioned response.

Sight of Person

The visual perception of another individual by an observer.

Puff of Air

A brief, forceful emission of air often used in experimental psychology to test blink reflex or corneal reflex responses.

Q9: Amanda is an employee of the Kiwi

Q21: A public university's long-term bonds issued to

Q28: In a troubled debt restructuring involving only

Q48: Aaron purchases a taxicab (5-year MACRS property)for

Q60: Contributions to a Roth IRA:<br>I.May be rolled-over

Q68: Which of the following entities directly bear

Q101: A flood destroys Franklin's manufacturing facility.The building

Q113: The Section 1231 netting procedure involves several

Q121: In July 2016,Hillary sells a stamp from

Q128: Pidgeon,Inc.has the following gains and losses from