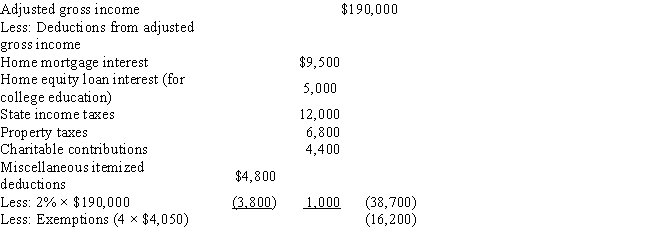

Rodrigo and Raquel are married with 2 dependent children,age 18 and 20,and reported the following items on their 2016 tax return:

Determine Rodrigo and Raquel's regular tax liability and,if applicable,the amount of their alternative minimum tax.

Definitions:

American Psychiatric Association

A professional organization of psychiatrists aimed at advancing the study, prevention, and treatment of mental illnesses.

Phrenologists

Pseudoscientific practitioners who believed that the shape and size of the cranium could predict personality traits, character, and mental abilities.

Medieval Doctors

Healthcare practitioners in the Middle Ages who often relied on a mixture of religious beliefs, superstition, and early medical practices to treat patients.

Penologists

Specialists in the study of penology, which focuses on the various aspects of the penal system, including the management of prisons and the rehabilitation of offenders.

Q1: Brooks Corporation distributes property with a basis

Q10: Wendell owns 115 acres of land with

Q18: If the U.S.Supreme Court denies a writ

Q24: On September 23, Gensil Company buys

Q46: Harrison Corporation sells a building for $330,000

Q57: Explain how a derivative instrument may be

Q62: Kelsey Nicholas contributes $80,000 to Wagner University

Q62: Which of the following statements regarding a

Q67: Alex is 37 years old,single and employee

Q87: The Tax Court will not necessarily follow