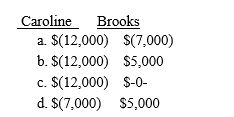

Brooks Corporation distributes property with a basis of $20,000 and a fair market value of $25,000 to Caroline in complete liquidation of the corporation.Caroline's basis in the stock is $32,000.What must Caroline and Brooks report as income (loss)upon the liquidation of Brooks?

Definitions:

Closed-Ended

Pertaining to questions or options that have a limited set of responses or choices.

Defensive

Relating to or intended for defense; marked by an effort to deny, evade, or avoid direct answer or action.

Client's Resistance

The opposition or reluctance of a client to engage with or continue with a service or intervention.

Q4: The total value of a derivative is

Q6: In a VIE, the majority of losses

Q28: This problem requires determining the type of

Q28: Dewey and Louie agree to combine their

Q53: During the current year,Swallowtail Corporation receives dividend

Q78: A public college or university would provide

Q83: In the Statement of Cash Flow for

Q85: The gain from the sale of qualified

Q89: Larry and Laureen own LL Legal Services

Q97: Unmarried taxpayers who are not active participants