Consider the following:

?

?

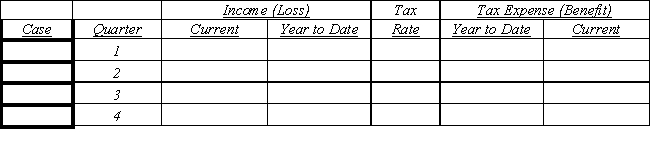

Case Income (loss) for quarters 1 through 4 is , and , respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be . No carryback benefit exists, and any future annual benefit is uncertain.

Case B Assume the same facts as in Case A. However, at the end of quarters 1 through 3 , annual income is estimated to be .

Case C Quarterly income (loss) levels were , ( , and . A yearly operating loss of was anticipated throughout the year. Frior years' income of is avail able for carryback. The same tax rates were relevant to the carryback period Required:

?

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

?

Definitions:

Hysterical

An outdated term historically used to describe excessive or uncontrollable emotion or excitement; now more commonly refers to being extremely funny.

Sociopath

A term used to describe a person with antisocial personality disorder, characterized by a disregard for the rights and feelings of others and often engaging in manipulative and criminal behavior.

Psychopath

An individual with a personality disorder characterized by persistent antisocial behavior, impaired empathy and remorse, and bold, disinhibited, and egotistical traits.

Borderline Personality Disorder

A mental health disorder characterized by pervasive instability in moods, interpersonal relationships, self-image, and behavior, often leading to impulsive actions and problems in relationships.

Q1: The following events occurred as part of

Q10: Which university fund is most similar to

Q18: L & S have invested $80,000 and

Q22: When an affiliated group elects to be

Q22: Pine Company purchased a 60% interest in

Q23: Betty Bloome died on February 28, 2015.The

Q32: Account balances are as of December 31,

Q36: The best fund in which to account

Q42: The financial statements required for private not-for-profit

Q63: Which of the following is not required