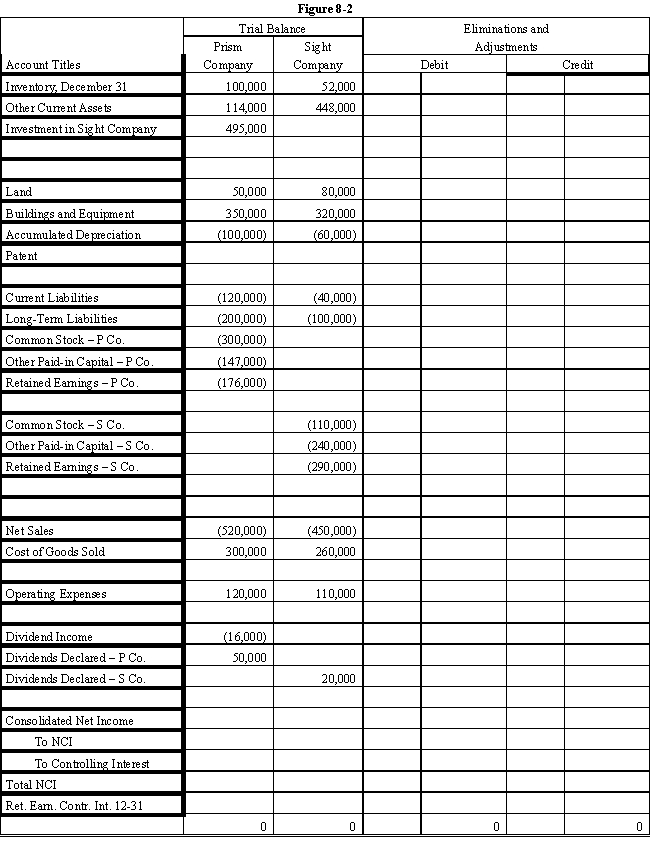

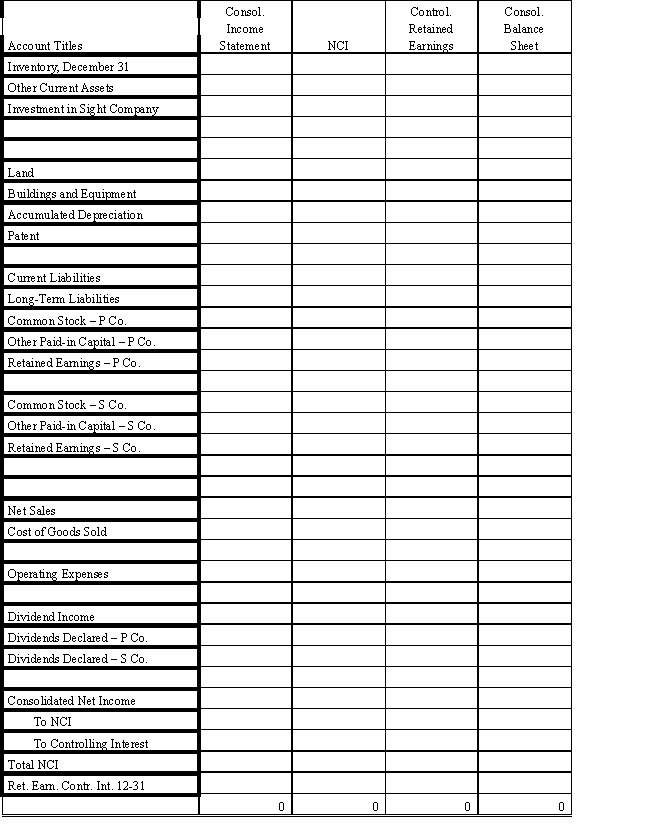

On January 1, 2016, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000.On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $200,000 and $300,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight using the cost method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-2 worksheet for consolidated financial statements for 2017.

?

?

?

?

Definitions:

Negative Figure

A value less than zero, often indicated in financial statements to represent losses, deficits, or outflows.

Comparative Balance Sheets

Financial statements that provide a side-by-side comparison of a company's financial position at different periods.

Horizontal Analysis

A financial analysis technique that compares historical financial data over a series of reporting periods to identify trends and growth patterns.

Trend Analysis

A method of financial analysis that allows one to predict future movements based on historical data.

Q2: A donation was received by a voluntary

Q5: Porch Company owns a 90% interest

Q16: Translation of a foreign entity's financial statements

Q21: An encumbrance most likely would be reported

Q24: General purpose financial statements are part of

Q24: D & E are equal partners and

Q28: In a company's disclosure of foreign currency

Q31: The City of Newport operates its own

Q38: Company P owns 80% of Company S.On

Q58: The following summary events are for