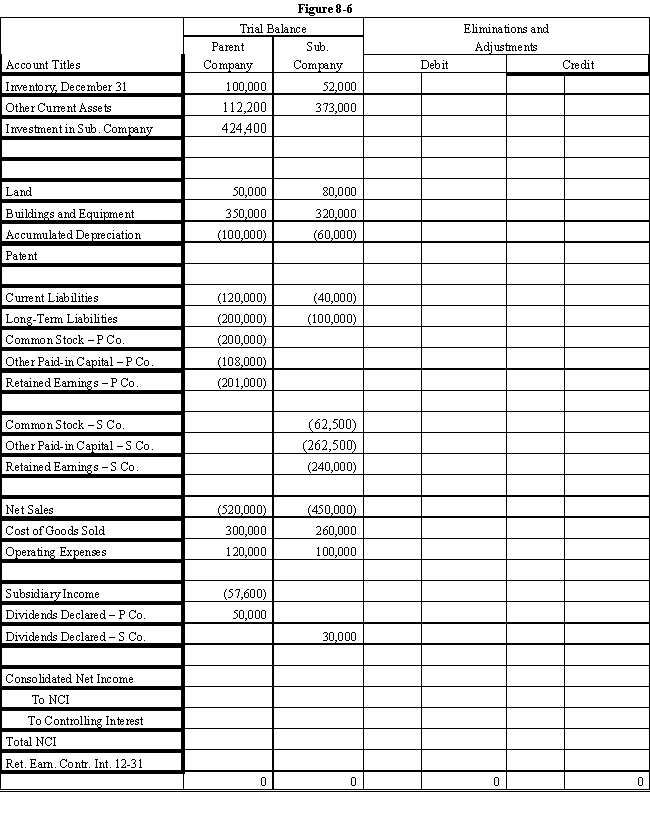

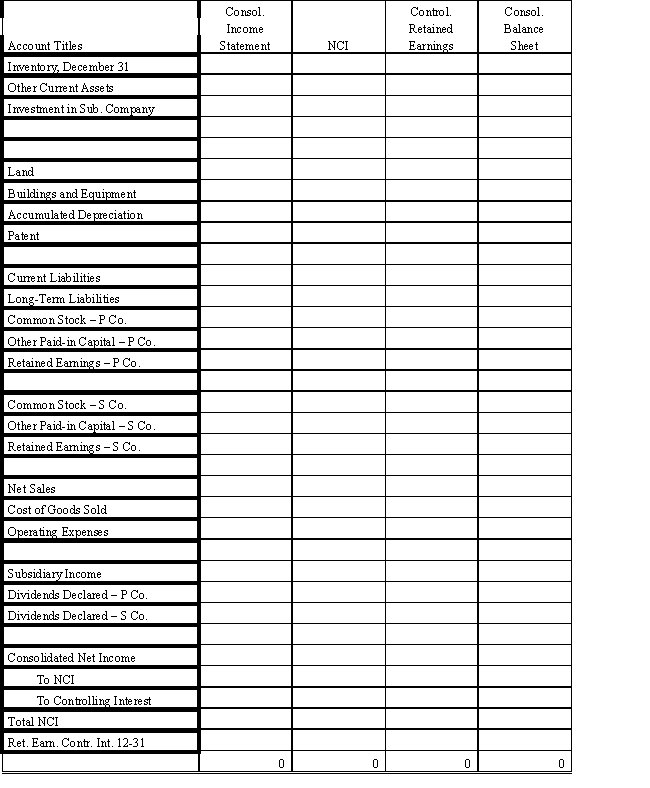

On January 1, 2016, Parent Company purchased 8,000 shares of the common stock of Subsidiary Company for $350,000.On this date, Subsidiary had 20,000 shares of $5 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $150,000 and $200,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.Parent Company uses the simple equity method to account for its investment in Sub.

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,500 shares of common stock to non-controlling shareholders for $50 per share.

?

In the last quarter of 2017, Subsidiary Company sold goods to Parent Company for $40,000.Subsidiary's usual gross profit on intercompany sales is 40%.On December 31, $7,500 of these goods are still in Parent's ending inventory.

?

Required:

?

Complete the Figure 8-6 worksheet for consolidated financial statements for 2017.

?

?

Definitions:

AFL

The American Federation of Labor, a historic federation of labor unions in the United States.

Minorities

Groups within a population that are distinguished by racial, ethnic, religious, or cultural identity and often experience differential treatment or representation.

AFL and CIO

The American Federation of Labor and Congress of Industrial Organizations, a federation of labor unions in the United States.

Rival Unions

Labor unions that compete for the representation rights and membership of workers within the same workplace or industry.

Q7: Assume a budget for City has been

Q13: Karl Marx and Freidrich Engels believed that

Q14: When a company purchases another company that

Q17: Balter Inc.acquired Jersey Company on January

Q25: Company P owns 80% of the 10,000

Q27: The earliest attempts to organize trade unions

Q41: During 2018, a parent company billed its

Q42: Which of the following must form part

Q42: On January 1, 2016, Parent Company purchased

Q50: Assume Champ Company will be translating the