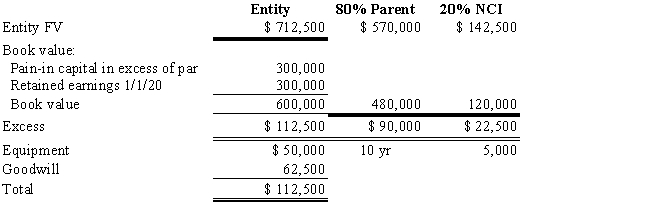

Company S has been an 80%-owned subsidiary of Company P since January 1, 2018.The determination and distribution of excess schedule prepared at the time of purchase was as follows:

?

?

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

On January 2, 2019, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000.No excess resulted from this transaction.Alpha earned $100,000 net income during 2019 and paid $20,000 in dividends.

?

The only change in plant assets during 2019 was that Company S sold a machine for $10,000.The machine had a cost of $60,000 and accumulated depreciation of $40,000.Depreciation expense recorded during 2019 was as follows:

?

?

The 2019 consolidated income was $180,000, of which the NCI was $10,000.Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

?

Consolidated inventory was $287,000 in 2018 and $223,000 in 2019; consolidated current liabilities were $246,000 in 2018 and $216,700 in 2019.Cash increased by $203,700.

?

Required:

?

Using the indirect method and the information provided, prepare the 2019 consolidated statement of cash flows for Company P.and its subsidiary, Company S.

Definitions:

Objective Theory

A legal principle stating that the intent in creating a contract is determined by the reasonable interpretation of the parties' actions and statements rather than individual subjective intentions.

Outward Manifestations

Refers to the actions or expressions by parties in a contract that show their intention to enter into the agreement.

Contract Law

The branch of law dealing with the formation, performance, and enforcement of agreements between parties.

Consideration

Something of value exchanged between parties in a contract, making the agreement legal and binding.

Q3: Assume a partnership has assets with

Q11: Discuss the conditions under which the SEC

Q17: Plymouth Company holds a 90% interest

Q19: On January 1, 2016, Pope Company acquired

Q23: A U.S.parent purchased a foreign subsidiary

Q31: Record the entry for the partnership of

Q32: Account balances are as of December 31,

Q38: Among the common pieces of labour relations

Q42: Revenues from voluntary non exchange transactions, such

Q55: The Canadian Labour Congress constitution sets out