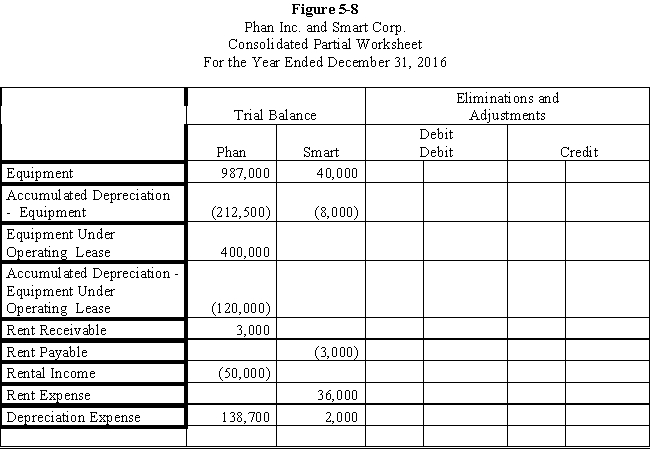

Smart Corporation is a 90%-owned subsidiary of Phan Inc.On January 2, 2016, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease.The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-8 partial worksheet for December 31, 2016.Key and explain all eliminations and adjustments.

Definitions:

Direct Evidence

Evidence that directly proves a fact without needing inference or presumption.

Court

A tribunal, often a governmental institution, with the authority to adjudicate legal disputes between parties and carry out the administration of justice.

Relevant Evidence

Information presented in court that directly relates to the facts in dispute and can help prove or disprove a point.

Direct Evidence

Evidence that directly proves a fact, without the need for inference or presumption, and which in its own right conclusively establishes the fact in question.

Q6: In most cases, which of the following

Q11: Ansfield, Inc.has several potentially reportable segments.The

Q16: What are the two primary reasons that

Q21: Smart Corporation is a 90%-owned subsidiary of

Q22: Which of the following is an important

Q24: Discuss the merits of accounting for subsidiaries

Q26: On January 1, 2016, Paul, Inc.acquired

Q41: Identify the first step in which partnership

Q45: What labour body represents workers' interests to

Q48: Hugh, Inc.purchased merchandise for 300,000 FC