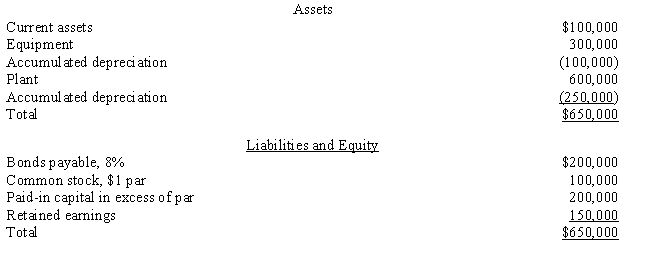

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash.The balance sheet for the Don Company on the date of acquisition showed the following:

?

?

Required:

Required:

?

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000.Assume that the Chan Corporation has an effective tax rate of 40%.Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

?

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.?

?

b.The bonds have a current fair value of $190,000.The transaction is a taxable exchange.?

?

c.There are $100,000 of prior-year losses that can be used to claim a tax refund.The transaction is a taxable exchange.?

?

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due.The transaction is a taxable exchange.?

Definitions:

Comprehension Skills

The ability to understand, process, and interpret written or spoken information.

English Words

Linguistic units of the English language used to convey meaning, consisting of vowels and consonants formed into meaningful sequences.

SQ3R Reading System

A reading comprehension technique including five steps: Survey, Question, Read, Recite, and Review, designed to improve understanding and retention of written information.

Retain

To keep in one's memory or possession; holding onto information or items.

Q1: On 6/1/17, an American firm purchased

Q8: Stroud Corporation is an 80%-owned subsidiary of

Q9: On January 1, 2016, Company P

Q9: What is a sweetheart agreement?

Q12: Which of the following is true regarding

Q14: ,A,B, and C have a partnership.Their capital

Q17: During this spirited stage of establishing the

Q28: On an income distribution schedule, any gain

Q36: The management team is more formally accountable

Q46: What is the percentage of the unionized