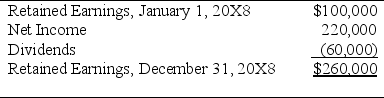

For the first quarter of 20X8,Vinyl Corporation reported sales of $150,000 and operating expenses of $100,000,and paid dividends of $20,000.Vinyl Company operates on a calendar-year basis.On April 1,20X8,Signature Corporation acquired 80 percent of Vinyl's common stock for $320,000.At that date,the fair value of the noncontrolling interest was $80,000,and Vinyl had 20,000 shares of $5 par common stock outstanding,originally issued at $12 per share.The differential is related to goodwill.On December 31,20X8,the management of Signature Corporation reviewed the amount attributed to goodwill as a result of its acquisition of Vinyl common stock and concluded that goodwill was not impaired.Vinyl's retained earnings statement for the full year 20X8 appears as follows:

Signature uses the fully adjusted equity method in accounting for this investment:

Required:

1)Prepare all entries that Signature would have recorded in accounting for its investment in Vinyl during 20X8.

2)Present all consolidating entries needed in a worksheet to prepare a complete set of consolidated financial statements for the year 20X8.

Problem 56 (continued):

Definitions:

Uruguay

A country located in the southeastern region of South America, known for its verdant interior and beach-lined coast.

Legal Liability

The responsibility under law to make restitution, compensation, or face penalties due to acts or omissions which are in violation of the legal statutes or the rights of others.

Summer Intern

is a temporary position offered by organizations, usually to students, that lasts through the summer months, providing practical experience in a particular field.

Culinary Degree

A formal educational certification specializing in the art and science of cooking and food preparation.

Q5: Based on the preceding information,the gain on

Q5: In reading a set of consolidated financial

Q9: A limited liability company (LLC):<br>I.is governed by

Q20: The computation of a safe installment payment

Q31: Based on the preceding information,what amount of

Q31: Form 8-K

Q37: Fox,Greg,and Howe are partners with average capital

Q42: In Pare's consolidating worksheet,what amount of unrealized

Q47: Based on the preceding information,in the entry

Q56: Dividends paid to noncontrolling shareholders:<br>I.are reported as