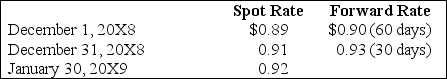

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

-Based on the preceding information,the entries on December 31,20X8,include a:

Definitions:

Standard Costs

Predetermined costs for manufacturing a product or delivering a service, used as targets or benchmarks.

Variances

The differences between planned, budgeted, or standard costs and actual costs.

Widgets

A generic term often used to refer to any product or manufactured item for examples or hypothetical situations.

Fixed Factory Overhead

The regular, consistent costs associated with operating a factory that do not vary with production volume, such as rent, salaries, and utilities.

Q20: Based on the preceding information,what amount of

Q20: Based on the preceding information,what balance would

Q24: Based on the information given above,what amount

Q28: Which of the following divisions of the

Q38: Smithtown Distributors acquired Paul's Plumbing on January

Q42: Based on the preceding information,at what amount

Q48: A wholly owned subsidiary sold land to

Q49: In order to avoid inequalities in the

Q58: Based on the preceding information,in the entry

Q69: Mazeppa,Inc.is a multinational entity with its head