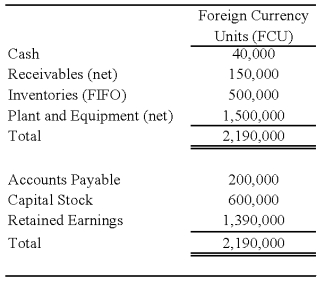

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

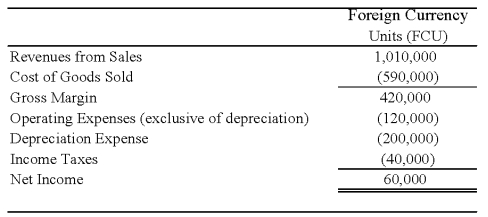

Perth's income statement for 20X8 is as follows:

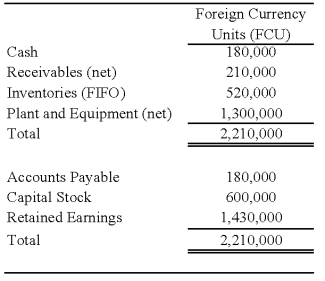

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

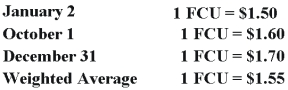

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of patent amortization for 20X8 that results from Johnson's acquisition of Perth's stock on January 2,20X8.Round your answer to the nearest dollar.

Definitions:

General Legal Competence

The basic ability to understand, participate in, and engage with legal processes.

CLA Exam

A certification test for legal assistants or paralegals to demonstrate their proficiency and professional competence.

APC Exam

A professional examination, potentially referring to the Assessment of Professional Competence, required in certain professions to assess one's ability to practise competently within that profession.

NALA

The National Association of Legal Assistants, a professional association for legal assistants and paralegals in the United States.

Q7: Based on the preceding information,what amount of

Q14: On January 1,2008,Pace Company acquired all of

Q19: Detroit based Auto Corporation,purchased ancillaries from a

Q28: Based on the information given above,the indirect

Q43: Due to an error,the general fund of

Q44: Based on the preceding information,what amount is

Q44: Based on the preceding information,what amount of

Q50: Based on the information given above,what amount

Q58: In 20X6,Dorian City received $15,000,000 of bond

Q76: The adjusted trial balance for White River