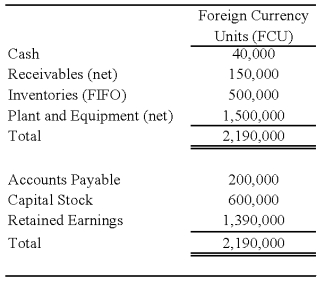

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

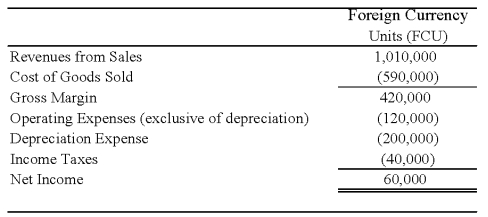

Perth's income statement for 20X8 is as follows:

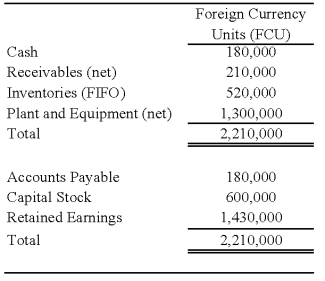

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

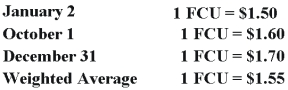

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Johnson's investment in foreign subsidiary account at December 31,2008?

Definitions:

Common Stock

A type of security that represents ownership in a corporation, giving shareholders voting rights and a share in the company's profits through dividends.

Noncash Investing

Investing activities that do not involve direct cash transactions, such as acquiring assets through exchange or issuing stock for assets.

Free Cash Flow

The amount of cash a company generates after accounting for capital expenditures required to maintain or expand its asset base.

Productive Capacity

The maximum output a system can produce over a set period under normal conditions.

Q6: Based on the information provided,the gain on

Q9: A private university offers graduate assistantships to

Q15: On January 1,20X8,Blake Company acquired all of

Q16: Based on the preceding information,in the journal

Q16: Based on the information provided,what amount of

Q35: Pisa Company acquired 75 percent of Siena

Q40: Based on the preceding information,which of the

Q57: Refer to the information provided above.Using a

Q57: Begin with information provided,but assume instead that

Q71: A state government collected income taxes of