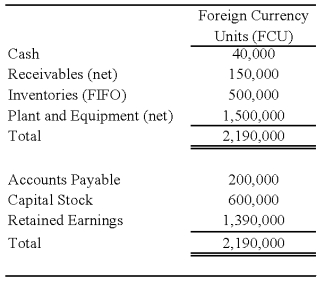

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:

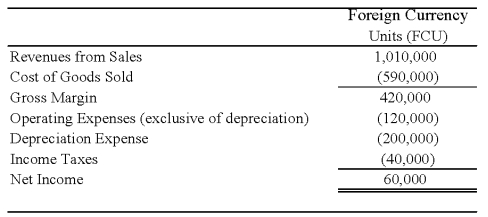

Perth's income statement for 20X8 is as follows:

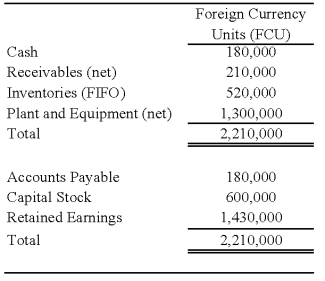

The balance sheet of Perth at December 31, 20X8, is as follows:

The balance sheet of Perth at December 31, 20X8, is as follows:

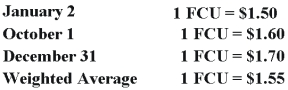

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Perth's net income for 20X8 in U.S.dollars (include the remeasurement gain or loss in Perth's net income) ?

Definitions:

Metabolism

The set of life-sustaining chemical reactions in organisms that involve the conversion of food to energy, the construction of proteins and nucleic acids, and the breakdown of waste products.

Fats

Nutrients that give energy, support cell growth, and help in the absorption of certain vitamins.

Niacin

A water-soluble B vitamin (B3) that is essential for energy metabolism and the health of the nervous system, skin, and digestive system.

GERD

Gastroesophageal Reflux Disease, a chronic condition where stomach acid flows back into the esophagus, causing heartburn and other symptoms.

Q2: The Board of Commissioners of the City

Q9: During the third quarter of 20X4,Ripley Company

Q15: Iona Corporation is in the process of

Q19: Which of the following are examples of

Q20: Based on the information given above,what amount

Q32: Which of the following is true? When

Q39: What account should be debited in the

Q49: In order to avoid inequalities in the

Q59: Paul and Ray sell musical instruments through

Q67: Based on the preceding information,the entries on