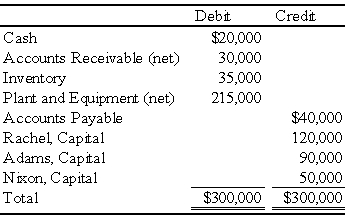

The partnership of Rachel,Adams,and Nixon has the following trial balance on September 30,20X9:

The partners share profits and losses as follows: Rachel,50 percent; Adams,30 percent; and Nixon,20 percent.The partners are considering an offer of $180,000 for the accounts receivable,inventory,and plant and equipment as of September 30.The $180,000 will be paid to creditors and the partners in installments,the number and amounts of which are to be negotiated.

The partners have decided to liquidate their partnership by installments instead of accepting the offer of $180,000.Cash is distributed to the partners at the end of each month.A summary of the liquidation transactions follows:

October

1.$25,000 is collected on accounts receivable; balance is uncollectible.

2.$20,000 received for the entire inventory.

3.$1,500 liquidation expense paid.

4.$40,000 paid to creditors.

5.$10,000 cash retained in the business at the end of the month.

November

6.$2,000 in liquidation expenses paid.

7.As part payment of his capital,Nixon accepted an item of special equipment that he developed,which had a book value of $8,000.The partners agreed that a value of $12,000 should be placed on this item for liquidation purposes.

8.$4,000 cash retained in the business at the end of the month.

December

9.$150,000 received on sale of remaining plant and equipment.

10.$1,000 liquidation expenses paid.No cash retained in the business.

Required:

Prepare a statement of partnership realization and liquidation with supporting schedules of safe payments to partners.

Problem 66 (continued):

Definitions:

Tilt

The inclination of an object, layer, or surface, often measured in degrees from the horizontal plane.

Glaciers

Large masses of ice that form on land from the accumulation and compaction of snow, moving slowly over time.

Seasonal Effects

The variations in natural or social phenomena that occur at specific times of the year due to Earth's changing position relative to the sun.

Isotopes

Variants of a particular chemical element that have the same number of protons but different numbers of neutrons.

Q1: Which of the following statements best describes

Q5: Based on the preceding information,what is the

Q9: Based on the information given above,what was

Q10: Based on the information given,which consolidating entry

Q12: Refer to the information provided above.Erin invests

Q21: Based on the preceding information,the receipt of

Q33: At any time,the remaining appropriating authority available

Q48: Briefly discuss the various types of governmental

Q48: Which of the following statements is true

Q65: Refer to Exhibit 1.5. What are the