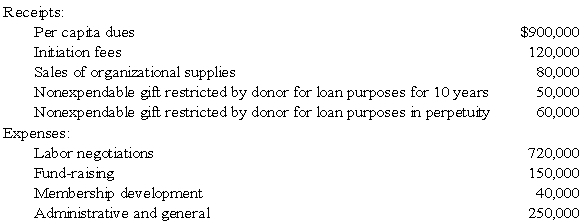

Golden Path, a labor union, had the following receipts and expenses for the year ended

December 31, 20X8:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of revenue from unrestricted funds?

Definitions:

Activity-Based Costing

A method in managerial accounting that assigns costs to products or services based on the activities and resources used in their production, enabling more precise cost management.

Machine-Hours

A measure of the total time that a machine is operated within a given period.

First Stage Allocations

The process in cost accounting where overhead costs are allocated to various cost pools or departments.

Processing Costs

Expenses involved in converting raw materials into finished products, including labor, overheads, and equipment usage.

Q3: Based on the preceding information,the journal entry

Q9: The following condensed balance sheet is presented

Q20: In accounting for governmental funds,which of the

Q25: Which of the following statements concerning Form

Q29: Which of the following accounts could be

Q35: Refer to the above information.Which statement below

Q44: Refer to the above information.What is the

Q47: The ABC partnership had net income of

Q55: In an investment policy statement, the objectives

Q120: For the year ended June 30,20X9,a university