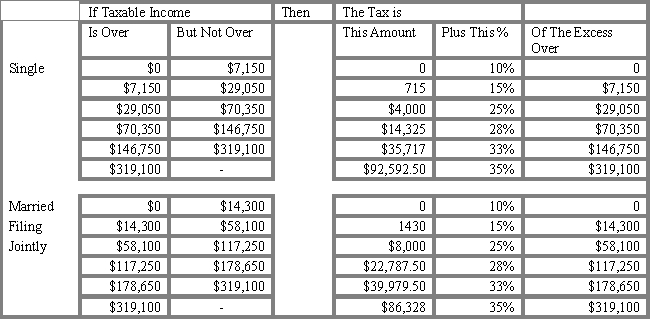

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the tax liability for a married couple filing jointly with taxable income of $125,000?

Definitions:

Kitchen Salaries

The total amount of wages paid to employees working in a kitchen over a specific period.

Federal Income Tax

A tax levied by the U.S. government on the annual earnings of individuals, corporations, trusts, and other legal entities.

FICA Taxes

Federal Insurance Contributions Act taxes, which fund Social Security and Medicare, required deductions from employees' paychecks and matched by employers.

FICA Taxes

Federal taxes in the United States that fund Social Security and Medicare, required to be withheld from an employee's paycheck.

Q5: The statement of changes in fiduciary net

Q20: On January 1,20X1,Washington City received 200,000 from

Q24: Refer to Exhibit 4.5. Calculate the price

Q26: On January 1,20X7,Gild Company acquired 60 percent

Q32: Refer to Exhibit 1.7. Calculate your holding

Q54: The current outlay of money to guard

Q58: Refer to Exhibit 4.5. Calculate the value

Q69: Which of the following is NOT a

Q73: Which of the following describes how a

Q112: Results of studies concerning corporate insider trading