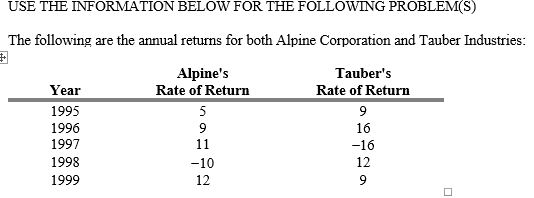

-Refer to Exhibit 2A.1. Calculate the coefficient of correlation.

Definitions:

Machine-Hours

A measure of production time wherein the focus is on the number of hours a machine is operated in the manufacturing of goods.

Casting Department

The casting department is a specialized segment within a manufacturing facility where metal casting processes are carried out to create metal parts.

Finishing Department

A section of a manufacturing company where goods are completed and prepared for sale.

Predetermined Overhead Rate

An estimated overhead rate used to allocate manufacturing overhead costs to products, calculated before the period begins.

Q3: Average tax rate is defined as total

Q5: An individual investor's utility curves specify the

Q14: "Basis for measuring investments in financial statements"

Q14: Experts suggest life insurance coverage should be

Q20: On January 1,20X1,Washington City received 200,000 from

Q26: The real risk-free rate is affected by

Q28: Based on the preceding information,what is the

Q52: A private,not-for-profit hospital received a cash contribution

Q74: A debt service fund of Clifton received

Q154: Technical analysis and the efficient market hypothesis