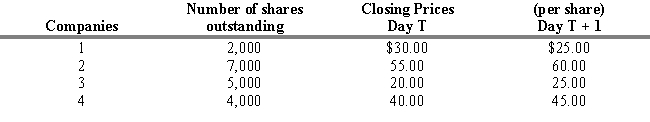

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.1. For a value-weighted series, assume that Day T is the base period and the base value is 100. What is the new index value for Day T + 1, and what is the percentage change in the index from Day T?

Definitions:

Glenn Beck

An American conservative political commentator, radio host, and television producer, known for his right-wing views, and the founder of TheBlaze, a multiplatform news and entertainment network.

Ben Bernanke

is known as a prominent economist who served as the Chairman of the Federal Reserve, the central banking system of the United States, from 2006 to 2014.

House Prices

The financial cost required to purchase residential property, which can fluctuate based on location, demand, economy, and other factors.

Economic Advisors

Experts or a group tasked with providing strategic economic counsel, typically to governments or large organizations.

Q15: Refer to Exhibit 7.9. Assume that you

Q17: Research has shown that the asset allocation

Q22: A debtor-in-possession balance sheet should report:<br>I.Liabilities not

Q30: Asset allocation is<br>A) the process of dividing

Q37: Modern portfolio theory assumes that most investors

Q60: Refer to Exhibit 1.10. Compute the rate

Q74: The following information is contained in the

Q90: Two approaches to defining factors for multifactor

Q110: Beta is a measure of<br>A) company specific

Q125: In a private,not-for-profit hospital,which fund would record