USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

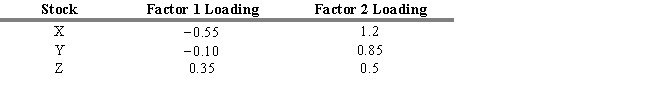

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested. The portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The weighted exposure to risk factor 2 for stocks X, Y, and Z are

Definitions:

Balance Sheet

A statement of finances that shows the assets, liabilities, and equity of shareholders of a corporation at a certain moment.

Revenue Account

An account that tracks the income earned from normal business operations, such as sales of goods or services, distinguished from other types of income.

Withdrawal Account

A withdrawal account is an account in a partnership or sole proprietorship from which an owner can withdraw his or her share of the business profits.

Closing Process

The closing process involves summarizing revenue and expense accounts and transferring net income or loss to owner's equity to prepare the company's books for the next accounting period.

Q2: A company is going public by selling

Q7: Refer to Exhibit 8.2. How much should

Q18: A portfolio management strategy that overweights a

Q26: Given a portfolio of stocks, the envelope

Q50: Refer to Exhibit 8.5. Assume that the

Q53: The expected return for Zbrite stock calculated

Q77: Refer to Exhibit 4.2. What is the

Q91: Which of the following statements about the

Q99: Refer to Exhibit 6.1. What is

Q100: A nonrefunding provision prohibits a call and