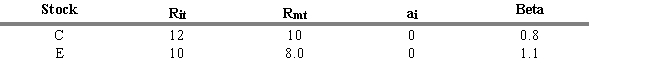

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.1. What is the abnormal rate of return for Stock C when you consider its systematic risk measure (beta) ?

Definitions:

Revised Act

Refers to an updated or amended version of a law or statute.

Distribution

The process of allocating or dispersing goods, resources, or dividends among multiple recipients.

Debt Securities

Financial instruments representing a loan made by an investor to a borrower, typically including notes, bonds, and bills, which are used by governments and corporations to raise funds.

Ownership Interest

A legal right or stake in property, indicating the owner's claim to control and benefit from it.

Q1: Refer to Exhibit 2A.1. Calculate the coefficient

Q7: 16.99%What is the expected return of the

Q43: The correlation coefficient and the covariance are

Q54: Between 1994 and 2004, the standard deviation

Q69: An investor is risk neutral if she

Q70: The two components that are required in

Q76: Rule 144A reduced registration documentation requirements for

Q83: The weak form of the efficient market

Q91: The betas for the market portfolio and

Q144: Fusion investing is the integration of the