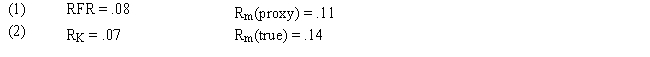

Assume that as a portfolio manager the beta of your portfolio is 1.3 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Standard Normal Distribution

A probability distribution that has a mean of zero and a standard deviation of one, also represented by the standard normal curve.

Z-score

A measure that describes a value's relationship to the mean of a group of values, represented in units of standard deviation.

Third Quartile

The value that divides the top 25% of a data set from the bottom 75%, often used as a measure of data spread.

Quartile

A type of quantile which divides the range of a probability distribution into four intervals of equal probability, used in describing the spread of a dataset.

Q4: The major U.S. stock indexes are highly

Q12: The key issues that investors seem to

Q24: Refer to Exhibit 3.3. What is Kathy's

Q33: An inconsistency between a stock's P/E ratio

Q40: The declaration date is the date that

Q45: Style investing involves constructing portfolios in such

Q51: Price-to-book value ratio cannot be used to

Q72: Operating free cash flow and free cash

Q115: Refer to Exhibit 9.7. What would the

Q130: If, for the S&P Industrials Index, the