USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

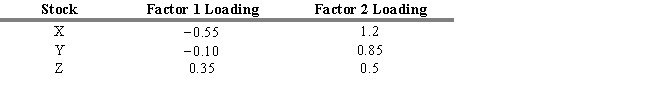

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested and the portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The net arbitrage profit is

Definitions:

Management Functions

The basic roles that managers perform in an organization, traditionally classified as planning, organizing, leading, and controlling.

Managerial Roles

Specific categories of managerial behavior including interpersonal, informational, and decisional roles.

Mintzberg's Ten

A framework of ten management roles categorized into interpersonal, informational, and decisional roles, developed by Henry Mintzberg.

Katz's Three

An organizational theory that identifies three primary managerial skills essential for successful management: technical, human, and conceptual skills.

Q28: The market is considered to be overbought

Q43: Which of the following is NOT a

Q48: What is the expected return of the

Q52: Refer to Exhibit 7.4. If the expected

Q68: The three-step valuation process consists of (1)

Q71: Refer to Exhibit 4.6. Calculate a price

Q103: Refer to Exhibit 7.3. The covariance between

Q109: A type of charting that normally disregards

Q132: Bond ratings are negatively related to<br>A) profitability.<br>B)

Q211: Refer to Exhibit 9.6. Calculate GDP for