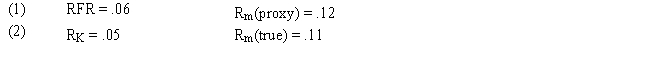

Assume that as a portfolio manager the beta of your portfolio is 1.4 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Willingness to Pay

The maximum price a consumer is prepared to pay for a good or service, reflecting its perceived value.

Marginal Benefit

The extra pleasure or benefit gained from the consumption of one more unit of a good or service.

Optimal Quantity

The quantity of a good or service that maximizes a firm's profits or an individual's utility, based on cost and benefit analysis.

Marginal Curve

A graphical representation of the marginal cost, marginal revenue, or marginal benefit of producing additional units of a good or service.

Q4: The major U.S. stock indexes are highly

Q22: In equity portfolio management, tracking error occurs

Q24: Refer to Exhibit 3.3. What is Kathy's

Q34: The NYSE series should have higher rates

Q37: The index of leading indicators includes all

Q47: Fundamentalists typically use the "Bottom-Up Approach", whereas

Q98: Refer to Exhibit 9.8. What is your

Q100: Refer to Exhibit 6.5. What is

Q107: A resistance level is the price range

Q113: According to the APT model, all securities