USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

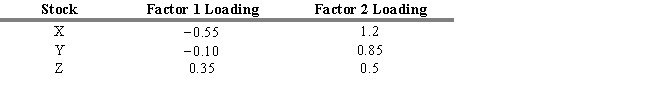

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected returns for stock X, stock Y, and stock Z are

Definitions:

Amygdala

A small, almond-shaped set of neurons located deep within the temporal lobe of the brain, involved in processing emotions.

Emotional Information

Data related to feelings or affective states that can influence cognition and behavior.

Temporal Lobe

A region of the cerebral cortex located beneath the lateral fissure on both cerebral hemispheres, associated with processing auditory information and encoding memory.

Hearing

The ability to perceive sound by detecting vibrations through an organ such as the ear.

Q2: Refer to Exhibit 6B.1. Show the

Q5: Beta can be thought of as indexing

Q18: Present value of free cash flow to

Q18: Markowitz assumed that, given an expected return,

Q20: Based on Stock Z's beta of 0.9

Q27: The goal of _ is to convince

Q48: The APT does not require a market

Q52: Refer to Exhibit 5.5. What is the

Q89: Refer to Exhibit 6.6. What is the

Q105: A basic assumption of the Markowitz model