USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

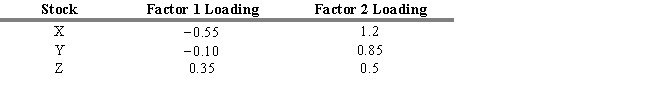

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected prices one year from now for stocks X, Y, and Z are

Definitions:

Ritualistic Respect

The expression of reverence or honor through established, ceremonious practices within a cultural or religious context.

Emics

The locally relevant components of an idea; in cross-cultural psychology, aspects of a phenomenon that are specific to a particular culture.

Etics

The universal components of an idea; in cross-cultural psychology, aspects of a phenomenon that all cultures have in common.

Individualisms

Individualism is a social theory favoring freedom of action for individuals over collective or state control.

Q10: Fama and French examined the relationship between

Q28: Which of the following is correct?<br>A) if

Q34: Which of the following is NOT considered

Q35: Refer to Exhibit 8.4. The present value

Q53: Consider two securities, A and B. Security

Q57: Refer to Exhibit 7.9. Assume that you

Q120: Advances and declines are associated with market<br>A)

Q140: The January anomaly refers to the phenomenon

Q149: The only way to estimate a beta

Q201: The economy and the stock market have