USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

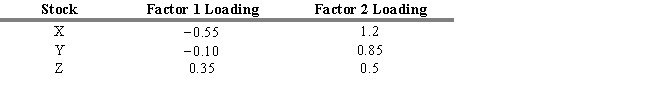

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested and the portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The net arbitrage profit is

Definitions:

Refurbish

The process of cleaning, renovating, or updating an item, particularly to restore it to a good condition or improve its functionality.

Terminated

Brought to an end or concluded, which can apply to contracts, employment, or any other agreement.

Security Company

A business that provides services related to the protection of physical property and assets, including surveillance, alarm systems, and private security personnel.

Alarm System

A device or set of devices designed to alert or warn individuals of potential danger, such as break-ins or fires.

Q14: Refer to Exhibit 4.1. Compute an unweighted

Q18: What is the value of a 10

Q34: Risk is defined as the uncertainty of

Q49: The slope of the utility curves for

Q57: In Berkshire Hathaway annual reports, Warren Buffet

Q65: Tactical asset allocation is used to determine

Q74: A style index created to track ethical

Q81: Refer to Exhibit 6.15. What is

Q89: The three major theories explaining the term

Q142: Because the market portfolio is reasonable in