USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

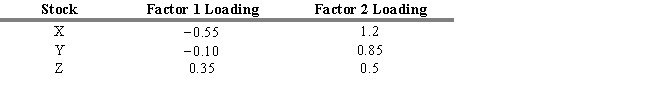

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested. The portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The weighted exposure to risk factor 2 for stocks X, Y, and Z are

Definitions:

Growth Stage

A phase in a company's or product's life cycle characterized by rapid revenue and customer base expansion.

Distribution Channels

Pathways through which a product or service passes until it reaches the end consumer, often involving intermediaries like wholesalers, retailers, or distributors.

Promotional Element

A component of a marketing strategy focused on communicating the value of a product or service to potential customers to increase awareness and sales.

Product Characteristic

Specific attributes or features that define a product and distinguish it from competitors.

Q9: The institutions that invest most heavily in

Q13: Which securities can be valued by dividing

Q28: An active portfolio manager sold $90 million

Q44: From 1980 to 2016, the average IPO

Q54: Refer to Exhibit 4.5. Calculate the unweighted

Q69: An investor is risk neutral if she

Q72: All of the following questions remain to

Q105: Which of the following is NOTa factor

Q151: Fama and French suggest a three-factor model

Q195: Which of the following statements concerning SWOT