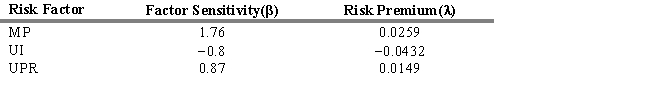

The table below provides factor risk sensitivities and factor risk premia for a three-factor model for a particular asset, where factor 1 is MP (the growth rate in U.S. industrial production) , factor 2 is UI (the difference between actual and expected inflation) , and factor 3 is UPR (the unanticipated change in bond credit spread) .  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

Definitions:

Pure Competitors

In a purely competitive market, companies sell products that are perfect substitutes for one another, leading to no control over market prices by individual firms.

R&D

Short for Research and Development, it refers to the activities undertaken by companies and organizations to innovate and introduce new products or services.

Innovation

The act of turning a concept or innovation into a product or service that adds value or that consumers are willing to purchase.

Copyright

A legal right granted to the creator of original works of authorship including literary, dramatic, musical, artistic, and certain other intellectual works, to control and profit from the use of their work for a certain period of time.

Q7: Two major classes of technicians include the

Q10: Refer to Exhibit 6.9. What is the

Q24: Which of the following is NOT considered

Q31: The least significant part of the registration

Q38: Which of the following statements concerning active

Q66: Empirical tests of the APT model have

Q70: In a macroeconomic-based risk factor model, the

Q109: A type of charting that normally disregards

Q189: Which of the following is a market

Q196: The Conference Board has derived the following