USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

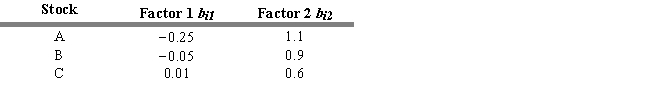

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Calculate the expected returns for stocks A, B, and C. A B C

Definitions:

Worm

A type of malware that replicates itself to spread to other computers, often utilizing a network, without needing to attach to an existing program for distribution.

Trojan

A type of malware disguised as legitimate software that can gain access to systems and cause damage or steal information.

Network

A collection of interconnected computers and devices that share resources and data.

Repetitive Strain Injury

Damage to the musculoskeletal and nervous systems that can occur from repetitive activities, forceful efforts, vibrations, mechanical pressure, or continuous or uncomfortable postures.

Q2: A company is going public by selling

Q3: The process of fundamental valuation requires estimates

Q25: The _ gives the investment bank the

Q30: A company is going public with an

Q45: Style investing involves constructing portfolios in such

Q48: The bonds issued by the Bank of

Q49: The strategy that frequently adjusts the asset

Q52: Underpriced stocks can be ranked using the

Q61: It is easier to construct an indicator

Q93: According to the segmented-market hypothesis, a rising