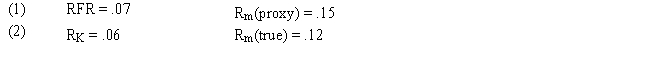

Assume that as a portfolio manager the beta of your portfolio is 1.1 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Investment Return

The gain or loss on an investment over a specified period, typically expressed as a percentage of the investment’s initial cost.

Savings Decisions

The process of determining how much money to set aside from current income for future use, often influenced by factors such as interest rates, economic expectations, and personal goals.

Capital Investment

The expenditure on physical assets like buildings, machinery, and equipment intended to increase the capacity or efficiency of a company.

Common Stock

A share of stock is an ownership claim on a firm, entitling its owner to a profit share.

Q2: Refer to Exhibit 9.13. Determine the justified

Q5: The Standard & Poor's International Index consists

Q9: A growth company may exist for all

Q16: Once the offering has been deemed effective,

Q20: Refer to Exhibit 3.2. If the maintenance

Q21: Corporate governance refers to the rules, policies,

Q40: Refer to Exhibit 5.6. What is the

Q66: Refer to Exhibit 9.2. What is your

Q74: In 2018, Swisten Inc. issued a $150

Q191: Estimating net profit margin directly is difficult