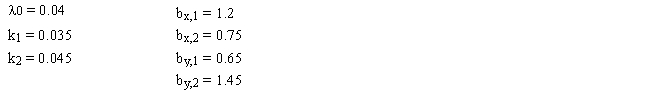

Under the following conditions, what are the expected returns for stocks X and Y?

Definitions:

Discount Rate

During discounted cash flow analysis, this is the rate employed to determine the present value of anticipated future cash flows.

Cash Flows

The total amount of money being transferred into and out of a business, often used as an indicator of a company's financial strength.

Discount Rate

The discount rate employed in discounted cash flow analysis to ascertain the present worth of future cash flows.

Annual Salary

The total amount of money that an employee earns in a year from their employer for their services.

Q18: The expected return for a stock, calculated

Q30: Using the constant growth model, an increase

Q31: In dividend discount models (DDM) with supernormal

Q50: An investor focusing on a growth strategy

Q53: Growth stocks would have the following characteristics:<br>A)

Q54: The expected rate of return on Rewind

Q72: Operating free cash flow and free cash

Q78: Of the following provisions that may be

Q135: Refer to Exhibit 9.2. To what price

Q154: In SWOT analysis, one examines all of