USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

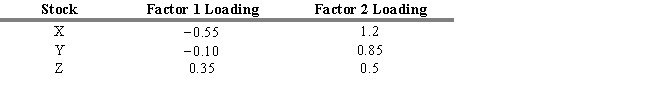

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected returns for stock X, stock Y, and stock Z are

Definitions:

Controlling Influence

The power to govern the financial and operating policies of an entity so as to obtain benefits from its activities, typically seen in parent-subsidiary relationships.

Held-To-Maturity Securities

Debt securities that a firm has the intent and ability to hold until they mature rather than trading them.

Trading Securities

Financial instruments bought and held primarily for selling in the near term to profit from price changes.

Unrealized Gain (Loss)

The increase (gain) or decrease (loss) in the value of investments that a company holds, which have not yet been sold for a profit or a loss.

Q4: Strategic asset allocation frequently adjusts the asset

Q11: A contrary opinion technician would buy stock

Q33: Refer to Exhibit 7.4. Which of the

Q35: Bond ratings are positively related to<br>A) leverage.<br>B)

Q35: A company is going public with an

Q78: The separation theorem divides decisions on _

Q83: Which of the following is NOT a

Q86: Which of the following is NOT considered

Q96: Assume that as a portfolio manager the

Q170: Refer to Exhibit 9.4. What is the