USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

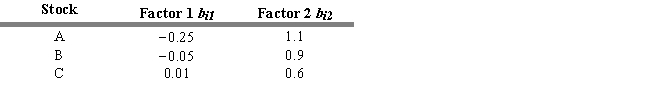

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Calculate the expected returns for stocks A, B, and C. A B C

Definitions:

Worksheet

A paper or electronic document used to organize and simplify accounting information before the preparation of financial statements.

Owner's Drawings

Withdrawals of business assets by the owner for personal use.

Income Summary

An account in which revenues and expenses are summarized, showing the net income or loss for a specific period before closing entries are made.

Net Income

Net income is the total revenue minus total expenses of a business, showing the company's profit during a specific period.

Q3: Between 1990 and 2000, the standard deviation

Q34: Which of the following is NOT considered

Q44: The initial effect of a change in

Q48: In order to confirm the weak-form efficient

Q51: Which of the following is NOT a

Q65: Ross Corporation paid dividends per share of

Q76: Calculate the expected return for B Services

Q96: With a differentiation strategy, a firm seeks

Q147: Refer to Exhibit 5.4. What is the

Q148: Refer to Exhibit 9.6. Estimate the firm's