USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

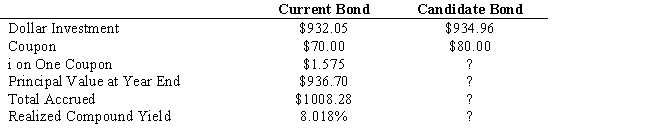

The following information is given concerning a pure yield pick-up swap: You currently hold a 10-year, 7 percent coupon bond priced to yield 8 percent. As a swap candidate, you are considering a 10-year, 8 percent coupon bond priced to yield 9 percent. Assume a reinvestment at 9 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.4. The interest on one coupon for the candidate bond is

Definitions:

Cash Flow

The comprehensive tally of funds being shuffled in and out of a corporation, impacting its short-term financial stability.

Creditors

Individuals, businesses, or financial institutions that have lent money or extended credit and are owed repayment of the debt.

Book Value

The net value of a company's assets, minus its liabilities and intangible assets such as goodwill.

Shareholders' Equity

The residual interest or ownership value remaining in a company's assets after deducting liabilities, representing the shareholders' stake in the company.

Q18: The goal of the stock pitch is

Q34: Refer to Exhibit 15.14. Calculate the return

Q53: Corporations can use many tools in order

Q56: Suppose the current six-year spot rate is

Q60: A firm has a current price of

Q72: A stock currently sells for $150 per

Q109: Refer to Exhibit 9.16. Calculate Rollerball Corporation's

Q111: The creation of the CBOE led to

Q132: Refer to Exhibit 15.14. Suppose at expiration

Q139: Porter contends that _ and _ are