USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

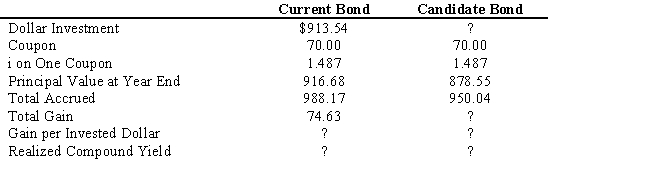

The following information is given concerning a substitution swap. You currently hold a 15-year, 7 percent coupon bond priced to yield 8 percent. As a swap candidate you are considering a 15-year, 7 percent coupon bond priced to yield 8.5 percent. Assume a reinvestment rate of 8.5 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.5. The value of the swap is ____ basis points in one year.

Definitions:

Discounted Note

A type of debt instrument that is sold for less than its face value and pays its face value at maturity, reflecting the discount as interest.

Face Value

The nominal or dollar value printed on a financial instrument, such as a bond or stock certificate, representing its value at issuance.

Take-Home Pay

Take-home pay is the amount of wages that an employee actually receives after all deductions, such as taxes and social security contributions, have been subtracted.

Gross Pay

The total amount of an employee's earnings before any deductions are made for taxes, benefits, and other payroll deductions.

Q10: If the price before yields changed was

Q14: In a ladder strategy, funds are invested

Q15: Which of the following is considered a

Q15: An investment bank can do an IPO

Q30: Which term-structure hypothesis suggests that any long-term

Q34: A company is going public with an

Q91: European options can only be exercised on

Q109: The best way for an investor to

Q117: Refer to Exhibit 13.7. The value of

Q185: Refer to Exhibit 9.6. Obtain an estimate