USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

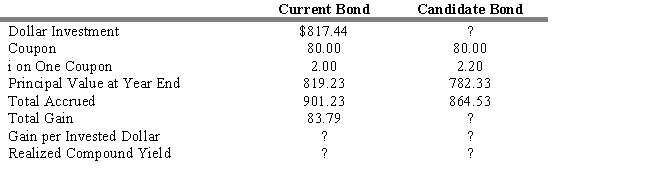

The following information is given concerning a substitution swap. You currently hold a 25-year, Aa 8 percent coupon bond priced to yield 10 percent. As a swap candidate you are considering a 25-year, Aa 8 percent coupon bond priced to yield 10.50 percent. Assume a reinvestment rate of 10 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.7. The realized compound yield on the current bond is

Definitions:

Risk And Return

The principle that the potential return on any investment is directly correlated with the amount of risk taken; higher risks typically offer the chance for greater rewards.

Average Variance

The mean of the squared deviations from the mean of a data set, indicating its volatility or variability.

Investment Period

The investment period is the duration over which an investment is held before it is sold or liquidated.

Rate Of Inflation

The annual percentage rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Q7: A security that has a coupon that

Q9: There is a direct relationship between a

Q17: Completeness funds are portfolios designed to complement

Q30: Which term-structure hypothesis suggests that any long-term

Q53: The closed-end fund index is<br>A) value weighted

Q77: Refer to Exhibit 9.6. Estimate the firm's

Q78: Refer to Exhibit 15.8. Calculate the initial

Q105: Funds that adjust the asset allocation weights

Q128: Consider a zero-coupon bond that has a

Q136: Based on the information provided, calculate the