USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

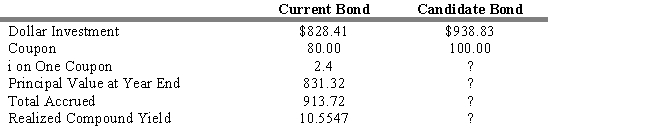

The following information is given concerning a pure yield pick-up swap: You currently hold a 20-year, Aa 8 percent coupon bond priced to yield 10 percent. As a swap candidate you are considering a 20-year, Aa 10 percent coupon bond priced to yield 10.75 percent. Assume a reinvestment rate of 12.00 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.6. The interest on one coupon for the candidate bond is

Definitions:

Q18: Assume that you purchase a three-year, $1,000

Q34: The following are examples of mutual fund

Q59: _ is a strategy used because the

Q78: Refer to Exhibit 14.5. The time premium

Q78: Refer to Exhibit 9.6. Calculate the firm's

Q91: A one-year call option has a strike

Q121: Which of the following statements regarding Collateralized

Q133: Refer to Exhibit 15.18. Suppose that three-month

Q139: Porter contends that _ and _ are

Q189: Which of the following is a market