USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

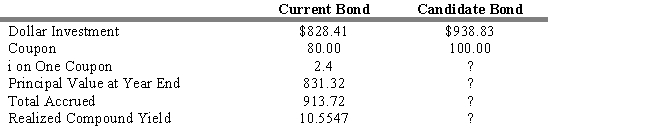

The following information is given concerning a pure yield pick-up swap: You currently hold a 20-year, Aa 8 percent coupon bond priced to yield 10 percent. As a swap candidate you are considering a 20-year, Aa 10 percent coupon bond priced to yield 10.75 percent. Assume a reinvestment rate of 12.00 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.6. The value of the swap is ____ basis points in one year.

Definitions:

Individual Need Satisfaction

The process of fulfilling personal desires, motivations, and requirements for well-being.

Communicating Information

The process of transmitting data, knowledge, or messages from one person or entity to another through various means.

Team Skill

The collective abilities of a group that enable successful collaboration, problem-solving, and achievement of common goals.

Lead a Team

The act of guiding and motivating a group towards achieving a common goal through effective leadership practices.

Q5: Derivative securities can be used<br>A) by investors

Q6: Mutual fund performance studies have shown that

Q12: The underlying stock price and the value

Q24: _ refers to the rules, policies, and

Q35: The Pekay Company has an FCFE of

Q42: The integrated asset allocation strategy separately examines

Q91: Calculate the yield to maturity of a

Q100: By attaching a convertible feature to a

Q129: The term structure of interest rates is

Q161: Unit labor costs, the rate of inflation,