USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

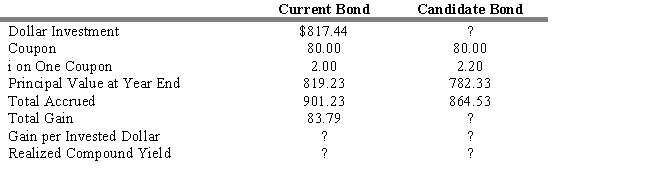

The following information is given concerning a substitution swap. You currently hold a 25-year, Aa 8 percent coupon bond priced to yield 10 percent. As a swap candidate you are considering a 25-year, Aa 8 percent coupon bond priced to yield 10.50 percent. Assume a reinvestment rate of 10 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.7. The realized compound yield on the current bond is

Definitions:

Wealthy Enough

Having sufficient financial resources or assets to live comfortably without financial stress or need.

Agricultural Work

Labor involved in farming, including the cultivation of crops and the rearing of livestock, a fundamental sector in many economies.

Kinship Patterns

The systemic relationships traditionally recognized among individuals and groups based on descent and marriage.

Q44: The settlement price is set by the

Q55: The legal document setting forth the obligations

Q74: Tom Gettback buys 100 shares of Johnson

Q112: All of the following factors affect the

Q113: Refer to Exhibit 16.8. If you establish

Q115: Refer to Exhibit 15.3. What is the

Q117: Which of the following statements concerning global

Q122: Treasury Inflation Protected Securities (TIPS) ensures that

Q134: Refer to Exhibit 9.2. What is the

Q175: Refer to Exhibit 9.18. Based on the