USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

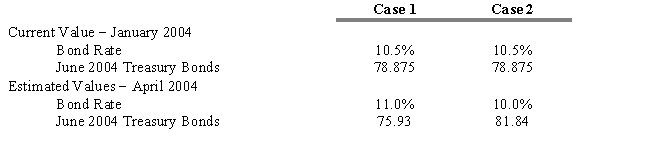

In late January 2004, The Union Cosmos Company is considering the sale of $100 million in 10-year bonds that will probably be rated AAA like the firm's other bond issues. The firm is anxious to proceed at today's rate of 10.5 percent. As treasurer, you know that it will take until sometime in April to get the issue registered and sold. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts each representing $100,000.

-Refer to Exhibit 15.1. What is the dollar gain or loss assuming that future conditions described in Case 2 actually occur? (Ignore commissions and margin costs) .

Definitions:

Legitimizes Capitalism

The process by which capitalist economies are justified and normalized within society, often through legal frameworks, cultural acceptance, and ideological support.

Socialist Agenda

A political or ideological plan that aims to promote social equality and the redistribution of wealth, often through the implementation of social welfare programs and the regulation or ownership of major industries by the community or state.

Final and Binding Arbitration

A dispute resolution process where an arbitrator or a panel makes a decision that is both conclusive and enforceable by law, with limited grounds for appeal.

Social Partnership

A model of industrial relations where employers, labor unions, and sometimes governments collaborate to negotiate and manage labor relations and economic policies.

Q1: Refer to Exhibit 15.11. How many contracts

Q13: All of the following are advantages of

Q20: Passive portfolio managers attempt to "beat the

Q49: Which factors indicate that in-depth credit analysis

Q53: Refer to Exhibit 13.2. If interest rates

Q54: The table below provides returns on a

Q57: Refer to Table 9-1.Use the table above

Q59: Refer to Exhibit 15.19. Assuming that one

Q90: If you were to purchase an October

Q137: Refer to Exhibit 15.2. What is the