USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

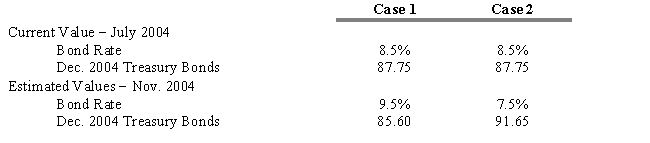

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. What is the dollar gain or loss assuming that future conditions described in Case 2 actually occur? (Ignore commissions and margin costs .)

Definitions:

Medical Treatment Discrimination

The unfair or unequal treatment of patients by healthcare providers based on race, gender, age, income, or other characteristics.

African Americans

In the United States, a group of people belonging to an ethnic or racial category that originates from any of the African black racial groups.

Coronary Heart Disease

A cardiovascular disorder characterized by narrowed arteries that supply blood to the heart, leading to heart attacks and chest pain.

Cardiologists

Medical doctors who specialize in the diagnosis and treatment of heart disease.

Q8: What is the offering price for a

Q22: Refer to Exhibit 13.7. The realized compound

Q32: Assume that you purchase a five-year, $1,000

Q40: Refer to Exhibit 15.6. If you expected

Q51: The basis (B<sub>t,T</sub>) at time t between

Q57: Refer to Table 9-1.Use the table above

Q68: When applying the Jensen's alpha measure, the

Q83: Revenue bonds are essentially backed by the

Q85: Automobiles and many other products are differentiated.As

Q115: Assume that you have just sold a