USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

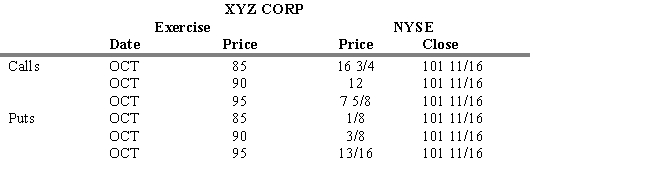

-Refer to Exhibit 16.8. If you establish a long straddle using the options with a 95 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16?

Definitions:

Operating Leverage

A financial measure of a firm's fixed versus variable costs, which assesses how revenue growth translates into growth in operating income.

Financial Leverage

The use of borrowed funds to increase the potential return on investment.

MM Model

The MM Model, or Modigliani-Miller Theorem, is a finance theory that suggests market value of a company is determined by its earning power and risk of underlying assets, independent of its capital structure.

Cost Of Equity

The return a company requires to decide if an investment meets capital return requirements, often used in capital budgeting to evaluate projects.

Q19: The following are all advantages of having

Q24: Firms disclose financial statements in _ and

Q55: Refer to Exhibit 15.5. Assume that a

Q61: Refer to Exhibit 13.12. Calculate the modified

Q74: Who is the seller in a primary

Q78: Under the performance attribution analysis method, the

Q81: Refer to Exhibit 15.3. If the bank

Q85: Suppose you consider investing $10,000 in a

Q94: Refer to Exhibit 15.2. How you would

Q95: Refer to Exhibit 15.159 Assume that one