USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

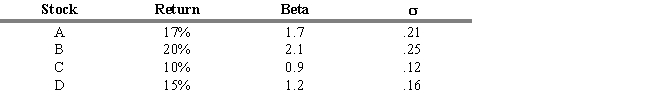

An analyst is considering investing in funds A, B, C, and D. The market portfolio, M, is expected to be 11 percent next period, and the risk-free rate of return is 3 percent. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds.

-Refer to Exhibit 18.8. Rank the four funds and market portfolio in order from highest to lowest based on their Sharpe measures.

Definitions:

Broca's Area

An area of the frontal lobe in the left hemisphere of the brain, associated with the production of language.

Pronouncing Words

Involves the action of making the sound of a word in a correct or particular way.

Stroke

A medical condition where poor blood flow to the brain results in cell death, causing loss of function in parts of the body.

Cortical Lesion

Damage to the outer layer of the brain, known as the cerebral cortex, which can affect various functions depending on its location.

Q8: Refer to Exhibit 14.3. If at expiration

Q28: In the evaluation of bond portfolio performance,

Q33: If the price elasticity of demand for

Q35: The World Trade Organization (WTO)promotes foreign trade

Q79: The financial statement that sums up a

Q82: A disadvantage of the Treynor and Sharpe

Q101: In the 1973 movie Save the Tiger,Jack

Q105: All of the following are normal characteristics

Q107: The Securities Act of 1933<br>A) contains various

Q129: When an investor buys a corporate bond,the