USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

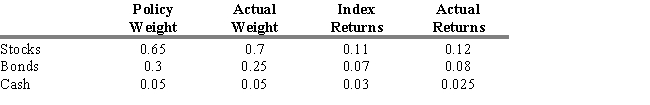

Consider the following information for a portfolio manager:

-Refer to Exhibit 18.12. Calculate the percentage return that can be attributed to the asset allocation decision.

Definitions:

Behaviour Problems

Actions or patterns of behavior that are considered inappropriate or disruptive based on societal or developmental norms.

Classical Fear Conditioning

A form of classical conditioning where a neutral stimulus is paired with an aversive stimulus to elicit a fear response.

Mowrer's Two-process Theory

A psychological theory proposing that avoidance learning is a combination of classical conditioning and operant conditioning.

Operant Avoidance Learning

A learning process in which the subject acquires a behavior to prevent or avoid an unpleasant stimulus.

Q19: Hedge funds are far less liquid than

Q24: Closed-end investment companies never sell at discounts

Q28: Compared to buying stock in a privately-held

Q32: Assume that when the price of cantaloupes

Q53: Refer to Exhibit 15.2. What is the

Q55: David Myers,former controller for WorldCom,pleaded guilty to

Q66: Refer to Exhibit 18.7. Based on the

Q85: In the valuation of an option contract,

Q88: A hedge strategy known as a collar

Q120: The standardization of option contracts and the