You are serving as the trustee for the Paul Porter testamentary income trust.The trust was created by Paul's will.All of his assets were transferred to the trust to cover the living expenses of his wife, Paula.Upon her death, the assets are to be sold, with the proceeds distributed to his brother, Saul.If Saul is not alive when Paula passes, the proceeds are to go to the Porter Scholarship in Business Administration.

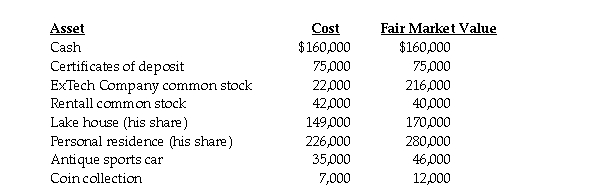

The probate court has ruled that all personal effects and household items could be excluded from the estate.All taxes have been paid, and the following assets remain to be transferred to the trust:

Required:

Required:

Prepare the journal entries for the creation of the trust.

Definitions:

Short-Run Exposure

The risk faced by companies due to fluctuations in exchange rates that can affect their transactions and finances in the near term.

Translation Exposure

The risk that a company's financial statements can be affected by changes in exchange rates when they have operations in foreign currencies.

Depreciation

The accounting method of allocating the cost of a tangible or physical asset over its useful life.

Financial Statements

These are formal records of the financial activities of a business, person, or other entity, providing an overview of a financial position at a point in time.

Q2: What is the purpose of interim reporting?<br>A)

Q10: Governments must record a liability for uncollected

Q15: Tye, Ula, Val, and Watt are partners

Q26: Palm owns a 70% interest in Sable,

Q55: Consider the following statements: a.Consumers rent more

Q73: Refer to Figure 1-1.Using the information in

Q124: Refer to Table 11-2.The table above refers

Q135: Which of the following is typically considered

Q144: Marv Pilson has $50 worth of groceries

Q145: During the 2011 Super Bowl,Best Buy ran