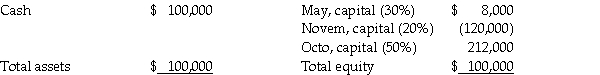

The partnership of May, Novem, and Octo was dissolved.By August 1, 2011, all assets had been converted into cash and all partnership liabilities were paid.The partnership balance sheet on August 1, 2011 (with partner residual profit and loss sharing percentages)was as follows:

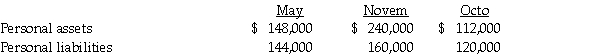

The value of partners' personal assets and liabilities on August 1, 2011 were as follows:

The value of partners' personal assets and liabilities on August 1, 2011 were as follows:

Required:

Required:

Prepare the final statement of partnership liquidation.

Definitions:

Fixed Assets

Long-term tangible assets that are used in the operations of a business and are not expected to be converted to cash in the short term.

CCA Class

In Canadian taxation, a system that groups depreciable properties into classes, with each having its own rate for Capital Cost Allowance, which is used to determine depreciation expenses.

Net Working Capital

The gap between an organization's immediate assets and its short-term obligations, showing its fiscal stability and proficiency in operations in the near term.

Required Return

The minimum return an investor expects to achieve by investing in a specific asset, considering its risk.

Q7: The estimated revenues control account of Metro

Q11: On February 1, 2011, George, Hamm, and

Q20: The partners of Nelatyna Manufacturing have decided

Q27: Johnson Corporation (a U.S.company)began operations on December

Q33: What basis of accounting is used to

Q33: Total utility is constant along a given

Q35: The City of Attross entered the following

Q109: Which of the following statements is true?<br>A)An

Q113: Suppose when the price of hybrid automobiles

Q139: Economists have used the ultimatum game and